Overview

400+

investors

$195m+

deployed

135+

cities

20-year

track record

13

funds

150

startups funded

Invest with Seraph

Broader Access to Deals

To investors, we offer diversified exposure to a portfolio of 20+ early-stage companies in high-growth sectors.

Smart Money for Startups™

To startups, we offer one line item on the cap table with money from some of the smartest and best connected people.

Be Involved

Find opportunities to advise, work with, and mentor entrepreneurs. It is, after all, the people behind the money that make all the difference.

Our Process

Seraph Group’s full-time professional investment team operates alongside a diverse and experienced investor base of over 390+ global LPs.

We identify key investment opportunities across various industries, sectors, and geographies.

Each opportunity is carefully vetted by our investment team and relevant industry experts within our network.

We invest our own money, set terms, then make the opportunity available to our LPs for co-investment at the same terms.

FUND OFFERINGS

Managed Funds

Our Structured Angel Funds take positions in 20+ early-stage companies, under the direct management of a partner.

Our Growth Equity Funds make follow-on investment in our best performing portfolio companies

INDIVIDUAL OFFERINGS

Independent Investing

Members can self-select and build a portfolio of curated and vetted investments in early stage, growth stage, or a combination of both.

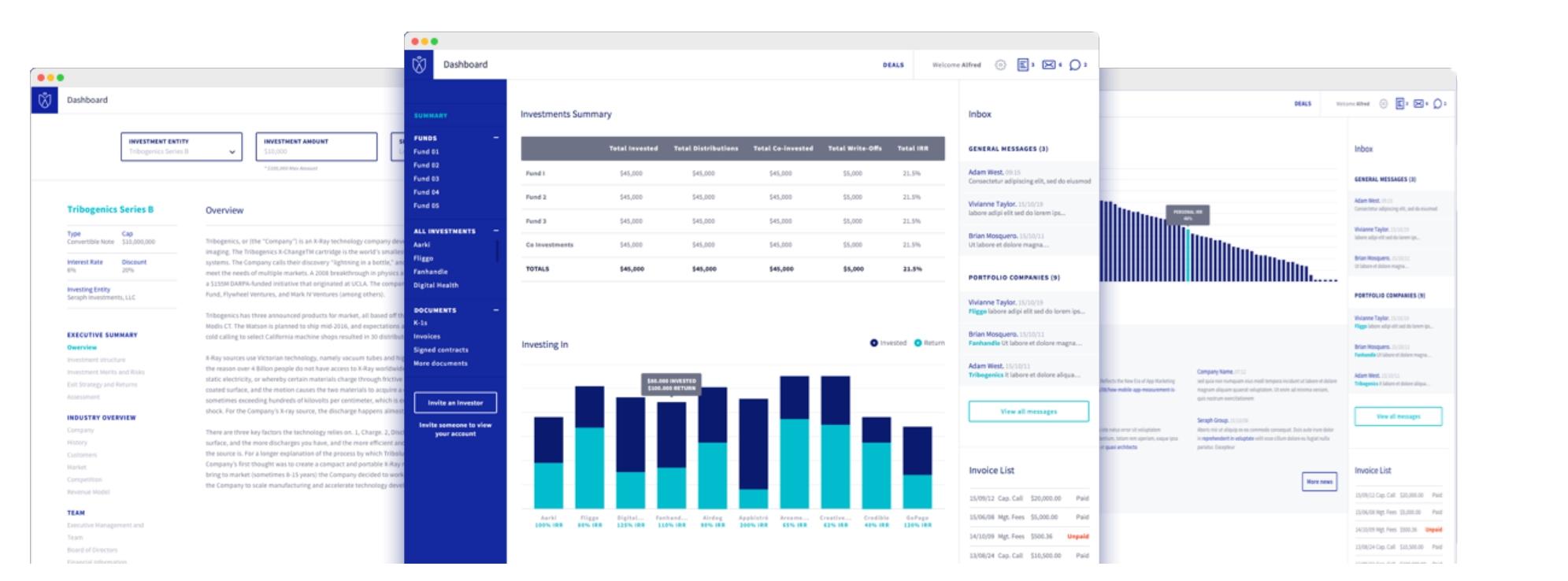

Our Investor Platform

Seraph Investors can access their fund and co-investment holdings, deal memos, semi-annual company reports, and tax filings through a personalized portal.

Qualification to Join

You must be an accredited investor according to the definition established by the United States Securities and Exchange Commission (SEC).