Our Model

We offer our entrepreneurs constant and dynamic support, from agile funding to expert guidance from our network.

We offer our investors access to a diversified portfolio of high quality done-deals.

These two key offerings are sides of the same coin: the more successful people we bring together, the better we can support the companies we fund.

Successful angel investment is incredibly difficult. At base, it requires:

- access to high quality and diverse investment opportunities,

- significant expenditure of time,

- deep knowledge across multiple industries,

- familiarity and expertise in business economics and value propositions,

- professional understanding of legal and financial terms and conditions,

- know-how in exits.

Seraph’s team, supported by our extended network, provides a solution to these challenges. We leverage our broad experience and deep knowledge to find, vet, and negotiate deals which we compose into our portfolios of 20-30 companies.

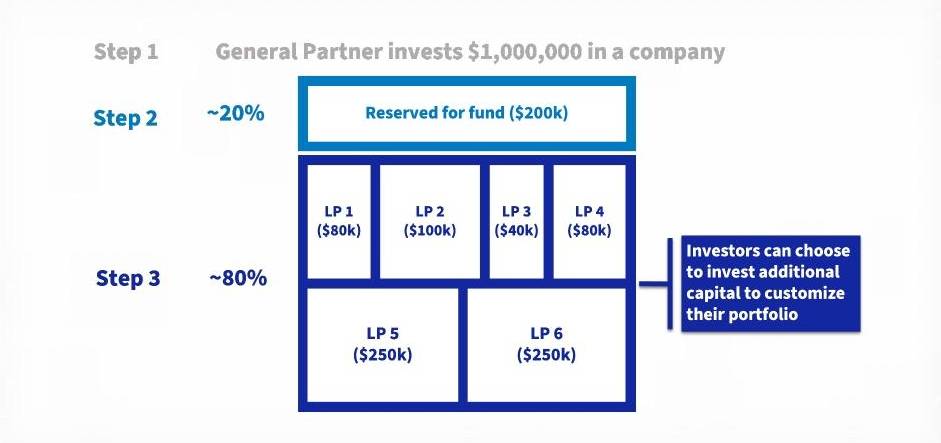

Our LPs benefit not only from this professionally managed portfolio, but also from the option make deal-by-deal co-investment. Portfolio companies present directly to our LPs, giving our network a chance to hear directly from the management, and from the Seraph investment team. They can then choose to supplement their portfolio with additional exposure to opportunities they think are the most promising.

The image below describes the typical breakdown of a fund investment, once it is offered for co-investment:

Community

Seraph Group’s full-time professional investment team operates alongside a diverse and experienced investor base of over 390+ global LPs.

Co-Investment

Seraph Investors can access their fund and co-investment holdings, deal memos, semi-annual company reports, and tax filings through a personalized portal.

Independent Investing

As members of Seraph, accredited investors can invest in deals without being in Structured Angel Fund. Members can choose to participate in live presentations/pitches and to make an investment of his or her liking. All deals offered are vetted and invested by Seraph team. Find more information below.

FUND OFFERINGS

Structured Funds

Our Structured Angel Funds provide the diversification of 20-30 companies based on each Limited Partner’s specific area of expertise.

INDIVIDUAL OFFERINGS

Independent Investing

Seraph connects accredited investors with curated, vetted investment opportunities in early-stage, high-growth companies.

Our Vision

Bridge the Funding Gap

Career venture capitalist and founder, Tuff Yen, recognized the difficulty of angel investing and the critical gap between Pre-Seed and Series A funding. To bridge this gap and create critical connections, he founded Seraph Group. The firm invests in industry and geography-agnostic, venture-scalable companies at the seed and early stages through our Structured Angel Fund™.

Since inception in 2004, Seraph invested more than $120 million in over 150 companies. This invitation-only firm consists of 390+ successful individuals including Fortune 500 C-level executives as well as entrepreneurs, scientist, engineers, inventors, technologists, consultants and others who share a passion of investing and backing promising founders.

What Is Seraph Group?

Learn More About Seraph Group

You must be an accredited investor according to the definition established by the United States Securities and Exchange Commission. If you qualify, please fill out the form below and someone will follow up promptly.